Asset liability matching or time based risk management are the technical names given to our unique process of selecting funds or asset classes based on the investment time horizon. This process is based on quantitative research that indicates that the time to maturity has the most significant impact on risk and in turn the attainment of any income goal. While a riskier asset class such as equity provides for the best returns it also introduces the most risk.

However time diversification, or holding equity for an appropriate longer time horizon, reduces this risk to a manageable level. Your portfolio is allocated by matching your cashflows (or income needs) based on their time horizon, providing cash when you need it from a low risk low return portfolio and growth when you don’t need the cash. In times where such risky assets have fallen materially it may be beneficial to postpone rebalancing from such riskier categories to give such growth asset addition time. By selecting this review strategy, rebalances will take place from the least risky category (based on the above quantitative analysis referred to) and only to into the cash category as determined by the required income.

Follow these steps to postpone the rebalance:

- Start the review of the investment.

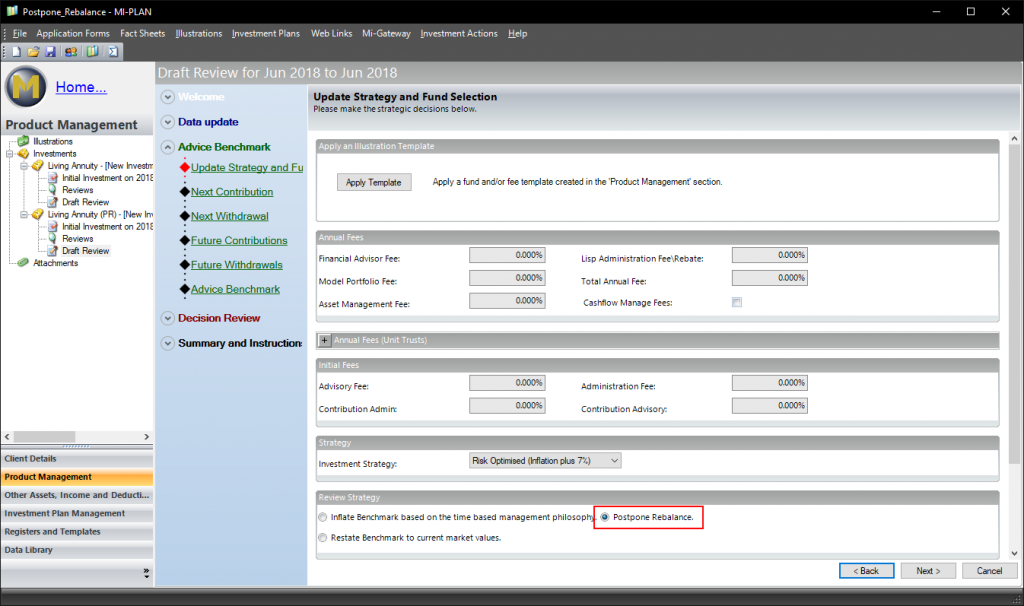

- Continue with the review as you would normally do until you reach the “Update Strategy and Fund Selection” section on the left.

- If you would like to postpone the rebalance select the Postpone Rebalance option.

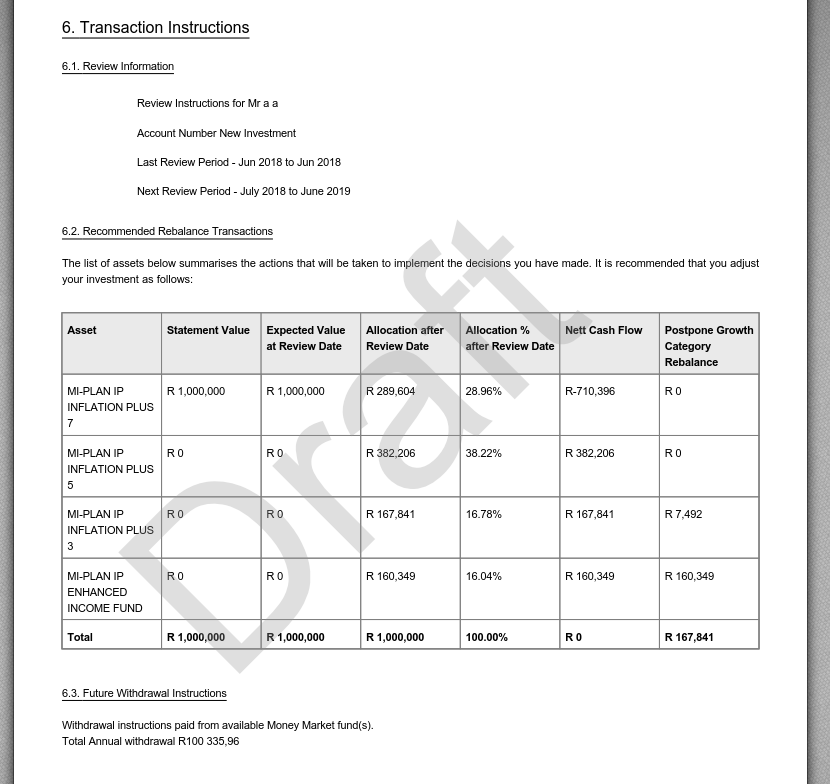

- Continue the review until you get to the “Summary ” section and review the values calculated in the Postpone Rebalance column.

- Click preview report so that the investment and be reviewed by your client. The Postponed Rebalance will be displayed in the report.